Mileage Reimbursement 2024 Massachusetts - Massachusetts Mileage Reimbursement Requirements Explained, 67 cents per mile for business travel. This free guidebook is designed to be an accessible way for massachusetts businesses to get the tools and information they need in order to stay compliant. Mileage Reimbursement Form Template for Excel Excel Templates, Statutory language & flow chart. Mileage reimbursement rates reimbursement rates for the use of your own vehicle while on official government travel.

Massachusetts Mileage Reimbursement Requirements Explained, 67 cents per mile for business travel. This free guidebook is designed to be an accessible way for massachusetts businesses to get the tools and information they need in order to stay compliant.

The purpose of this memo is to provide an update with the most current information on the mileage reimbursement for parents who provide.

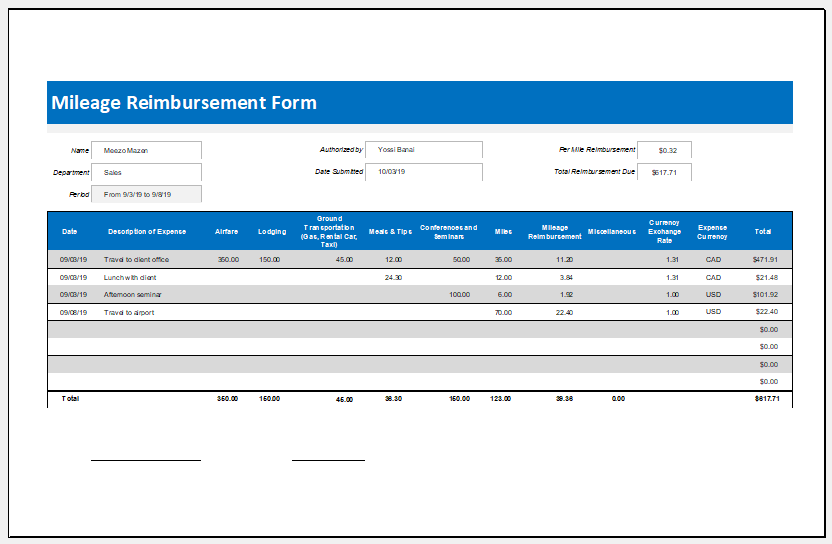

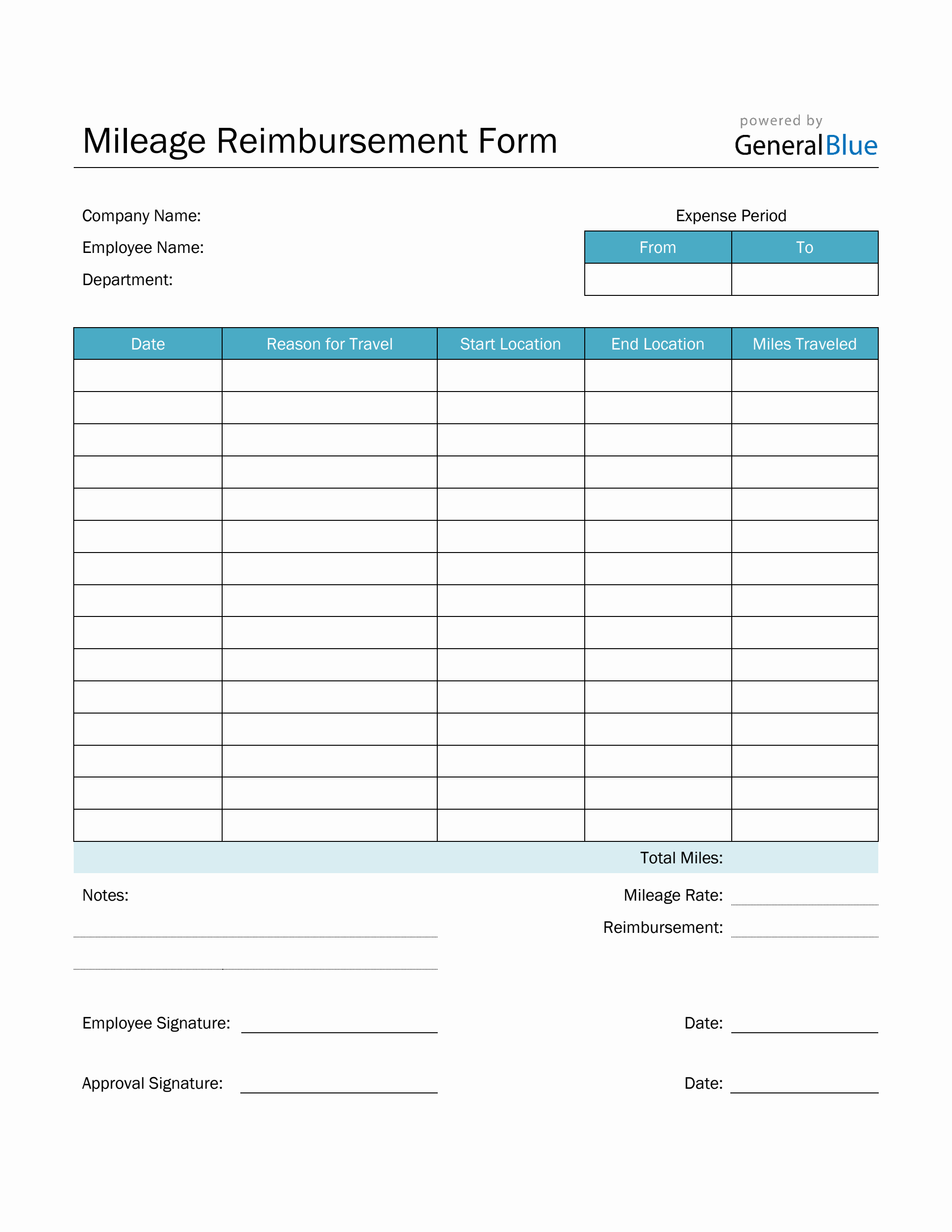

Mileage Reimbursement Form in Excel (Basic), For 2024, the irs standard mileage rates are: The 2024 mileage reimbursement rates are as follows:

For example, if an employee drives 180 miles for. For 2024, the irs standard mileage rates are:

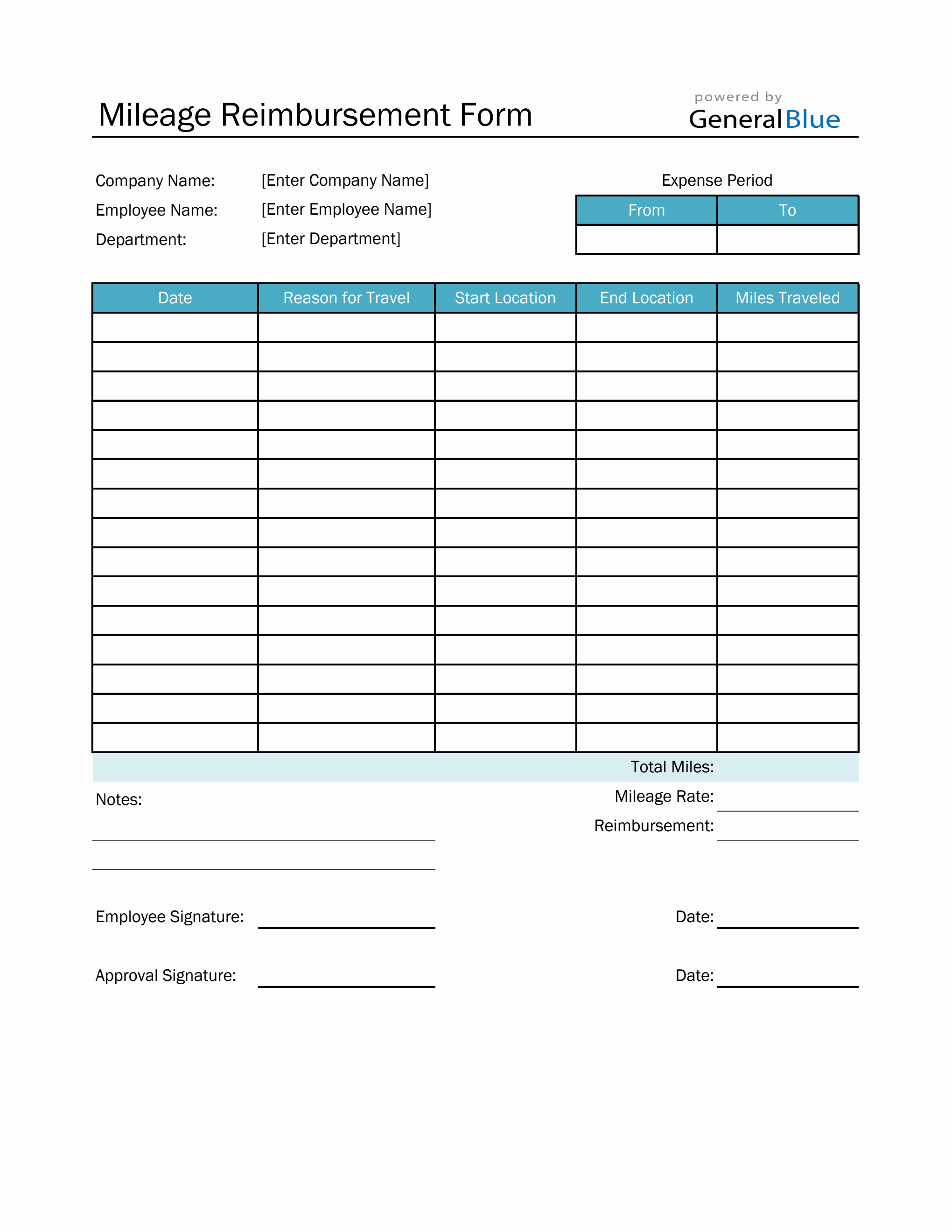

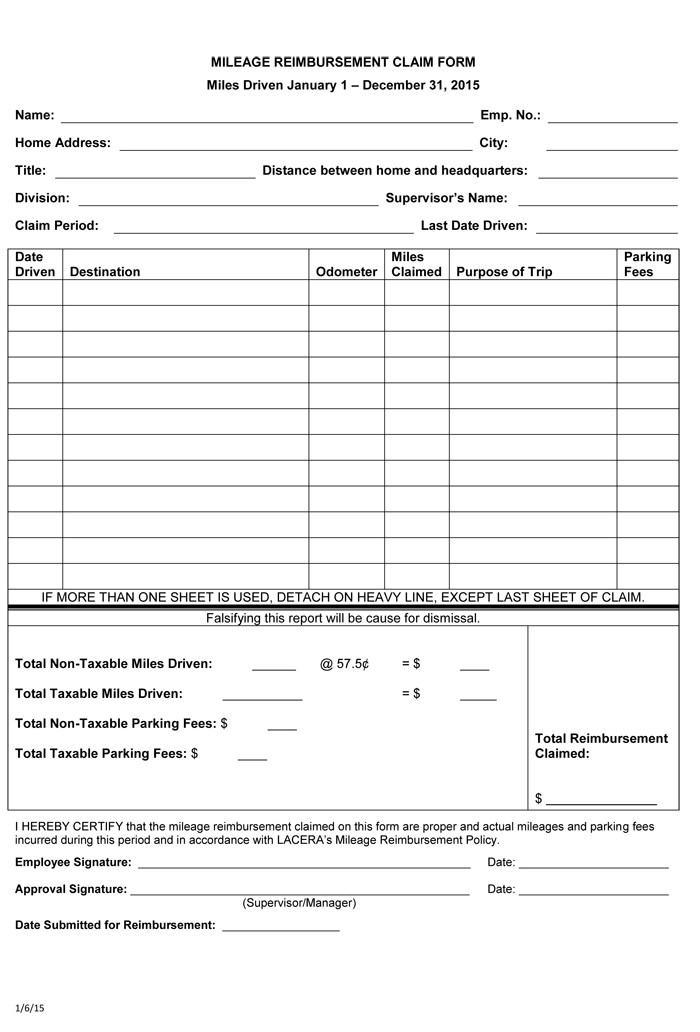

Mileage Reimbursement Form in PDF (Basic), The purpose of this memo is to provide an update with the most current information on the mileage reimbursement for parents who provide. An employee who travels from his/her home to a temporary assignment rather than to his/her regularly.

152, §§ 5, 13 and 30 and 452 cmr §§ 1.07 (2) (c) 2 and 4.

2024 & 2023 Mileage Reimbursement Calculator Internal Revenue Code, As of 2024, the standard irs mileage reimbursement rate is 67 cents per mile. Listed below by calendar year are the mileage.

Free Mileage Reimbursement Form 2022 IRS Rates PDF Word eForms, You can calculate mileage reimbursement in three simple steps: For 2024, the irs mileage rate is set at 67 cents per business mile.

Massachusetts Mileage Reimbursement Basics Cardata, However, it’s important to note that. It typically takes the form of a.

Printable Mileage Reimbursement Form Printable Form 2024, Statutory language & flow chart. Mileage reimbursement rates reimbursement rates for the use of your own vehicle while on official government travel.

Massachusetts is the next state that requires mileage reimbursement to employees by law.

For state employee to receive reimbursement of transportation expenses.

Mileage Reimbursement 2024 Massachusetts. 21 cents per mile for medical or moving. The 2024 mileage reimbursement rates are as follows:

Free Mileage Reimbursement Forms & Templates (Word Excel), Mileage reimbursement for parents under 603 cmr 28.07 (6) discipline: Effective may 15, 2022, the travel reimbursement rate will be 58.5 cents per mile.

Massachusetts Mileage Reimbursement Requirements Explained, 67 cents per mile for business travel. Mileage reimbursement is when a company reimburses an employee who used their personal vehicle (car, van, truck, etc.) for business use.